Latest

RAMpocalypse Now – Embedded-Edition 2026

DDR & NAND memory in stress testing: What matters now

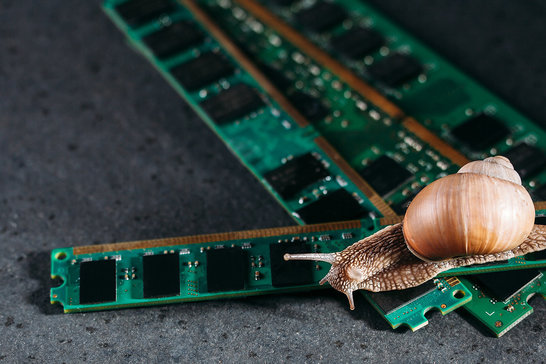

Storage bottleneck

What was long considered a problem affecting only PCs and servers will hit the embedded world with full force in 2026. DRAM and NAND manufacturers are shifting their capacities massively toward servers, AI, and HBM. For embedded systems, this means one thing above all: rising prices, longer delivery times, and growing risks for ongoing series.

Current market figures clearly underscore this development. TrendForce expects price increases of +55–60% for conventional DRAM and +33–38% for NAND for the remainder of the first quarter of 2026. This affects not only new designs, but also, in particular, already qualified series products for which redesigns are expensive or hardly realistic.

Market under pressure

The background to this development can be reduced to three key points. First, server and AI applications have clear priority. HBM, server DRAM, and enterprise SSDs are high-margin products and are therefore given preferential treatment in manufacturing. As a result, classic DDR3 and DDR4 components and embedded NAND are slipping further and further behind.

Second, prices are rising not only on the spot market, but also in existing contracts. DRAMeXchange shows continuous price increases. Although there are always short breaks around the Chinese New Year, the basic trend is clear: upward. Thirdly, there is no relief in sight in the short term. Micron is investing in a new NAND fab in Singapore, but production is not scheduled to start until H2/2028 at the earliest. This does not provide any relief for current embedded projects.

DDR3 remains critical in embedded systems, DDR4 and DDR5 overshadowed by the HBM boom

Many established processor platforms that have been running stably in series for years still require DDR3 or DDR3L. It is precisely this area that is becoming increasingly scarce, especially for higher memory densities. The reason for this is not so much a sudden change in technology as a gradual shift: legacy DRAM is losing manufacturing capacity to DDR5 and HBM.

This will not lead to the abrupt disappearance of DDR3, but it will have noticeable effects (rising prices, less choice, and an increased EOL risk). For long-life embedded products, this is a serious issue that should be addressed at an early stage.

The picture is similar for DDR4. Production lines are increasingly shifting toward server DRAM and HBM. DDR4 remains technically established, but is becoming significantly more volatile in terms of procurement. For embedded teams, this means that those who allocate and secure contracts early on will gain a clear advantage. Spot procurement is becoming increasingly expensive, especially when EMC testing, approvals, and validations have already been completed and a change at short notice is hardly possible. TrendForce also expects further price increases in Q1/2026.

NAND & Flash - Embedded Systeme stehen hinten an

Auf der NAND-Seite zeigt sich ein ähnliches Muster. Enterprise-SSDs werden priorisiert, während Client-SSDs, eMMC und industrielle NAND-Komponenten für Embedded-Boards zunehmend verdrängt werden. In der Praxis führt das zu steigenden Vertragspreisen, längeren Lead-Times und erhöhten Risiken für Serienproduktionen, vor allem im Industrial-Umfeld.

Option China – Opportunity with conditions

Against this backdrop, Chinese memory manufacturers are coming more into focus. The most relevant players here are CXMT in the DRAM sector and YMTC for NAND, supplemented by suppliers such as Longsys and FORESEE, among others for DDR3. China now holds around 5% of the global DRAM market (2024) – and the trend is rising.

Technically, DDR3L, DDR4L, and NAND components from China are generally available and qualifiable. However, we recommend a significantly increased level of testing, for example through thermal cycling, aging tests, and margining. At the same time, market reports show that CXMT could focus more strongly on DDR5 in the future. For long-life designs, this increases the roadmap and EOL risk, which is why multi-source strategies are becoming imperative.

On the NAND side, YMTC delivers modern 3D NAND generations on par with established manufacturers. Nevertheless, compliance and export requirements must be carefully examined depending on the industry. In short, Chinese memory is an option—if qualification, compliance, and alternatives are professionally set up. For regulated applications such as medical technology, redundant strategies are indispensable.

What embedded project teams can do now

One key lever is to actively reduce memory requirements. Lean images, targeted logs, and clean update paths ensure that less RAM and flash density is needed. This increases the selection of available components and reduces dependence on the market.

Embedded distributions such as GELin help to keep the software footprint small – without unnecessary ballast. At the same time, memory variants should be broadened and qualified at an early stage. For DDR3 and DDR4, at least two approved sources are advisable; for NAND, eMMC, and SSD, support for multiple types should already be provided for in the design.

Another important point is contracts. Framework and allocation agreements covering six to 18 months with clear PCN and call-off regulations are currently the most stable way to navigate the market. On the flash side, it is also worth consciously managing the service life.

How Ginzinger supports you

Ginzinger electronic systems supports its customers and partners throughout the entire supply chain. From BOM stress tests for DDR3, DDR4, and NAND, to design and update strategies with power-fail-safe memory layouts, to procurement and life cycle management. The goal is to keep series production running smoothly, even when the market remains volatile. With the RAMpocalypse BOM check, you will receive a prioritized list of measures for your current design in 45 minutes. Together, we will secure your memory roadmap for 2026/27.

Sources

(As of February 2026)

- TrendForce / DRAMeXchange – Q1/2026: DRAM +55–60%, NAND +33–38%; prioritization of servers/AI; client SSDs displaced.

- IDC – Analysis of global memory shortage with effects until 2027.

- S&P Global Market Intelligence – HBM shift causes standard DRAM shortage, ASP increase in 2026.

- Micron (IR/EDB/Barron's) – New NAND fab in Singapore, output from H2/2028.

- Evertiq (DE/EN) – Summaries of price increases Q1/2026 (TrendForce).

- CXMT/YMTC (market status) – China gains share; DDR4→DDR5 shift possible;

- ISSI (DDR3/DDR3L) – Industrial/automotive flows, longevity programs